Momentum Investing: Recognising Trends Early and Profiting (Guest article)

What is Momentum Investing?

Momentum investing is a strategy based on a simple principle: stocks that have performed well in the past tend to continue to outperform in the future. Instead of relying on subjective forecasts, momentum investing is based on objective data - and therefore simply on historical returns.

Why Momentum Investing?

- Scientifically proven: Studies from the 1990s have shown that momentum strategies can achieve above-average returns in the long term. For example, Jegadeesh and Titman (1993) demonstrated that stocks with high performance over the past 3-12 months continue to achieve above-average returns in the following 3-12 months. Fama and French (1996) recognised momentum as one of the most significant anomalies that cannot be explained by the market premium (the difference between the expected return of a risky financial instrument and the risk-free interest rate), the size effect (the tendency for smaller companies to achieve higher returns than larger companies), or the value factor (companies with low valuations tend to achieve higher returns in certain periods than the broader market). Momentum strategies exploit market inefficiencies by benefiting from the aftereffects of positive or negative news. Stocks that have risen sharply tend to continue rising, while stocks that have fallen can continue to fall.

- No market predictions: The strategy does not make subjective stock selections based on balance sheets and income statements. Instead, it follows the market trend and lets the gains speak for themselves.

- By focusing on stocks with strong price performance, the momentum strategy can reduce the risk of investing in underperforming stocks. This can lead to better risk adjustment. A momentum strategy can serve as diversification within a portfolio, as it behaves differently from traditional long-only index strategies. This can improve the risk-return profile of the entire portfolio.

Why does Momentum Investing work?

Momentum investing is based on several hypothesized reasons:

- Investor inertia: Investors often react slowly to new information, leading to a delay in the full adjustment of stock prices.

- Herd behavior: Investors tend to follow trends, which amplifies stock price movements.

- Overreaction and underreaction: Markets tend to overreact to good or bad news and then correct, which momentum investors can exploit.

The Charm of the Momentum Strategy

The Momentum-Strategy is:

- systematic: It is based on clear rules for buying and selling stocks.

- disciplined: Strict application of the strategy without emotional actions.

- transparent: Understandable methods that any private investor can comprehend.

Unexpected Winners through Momentum

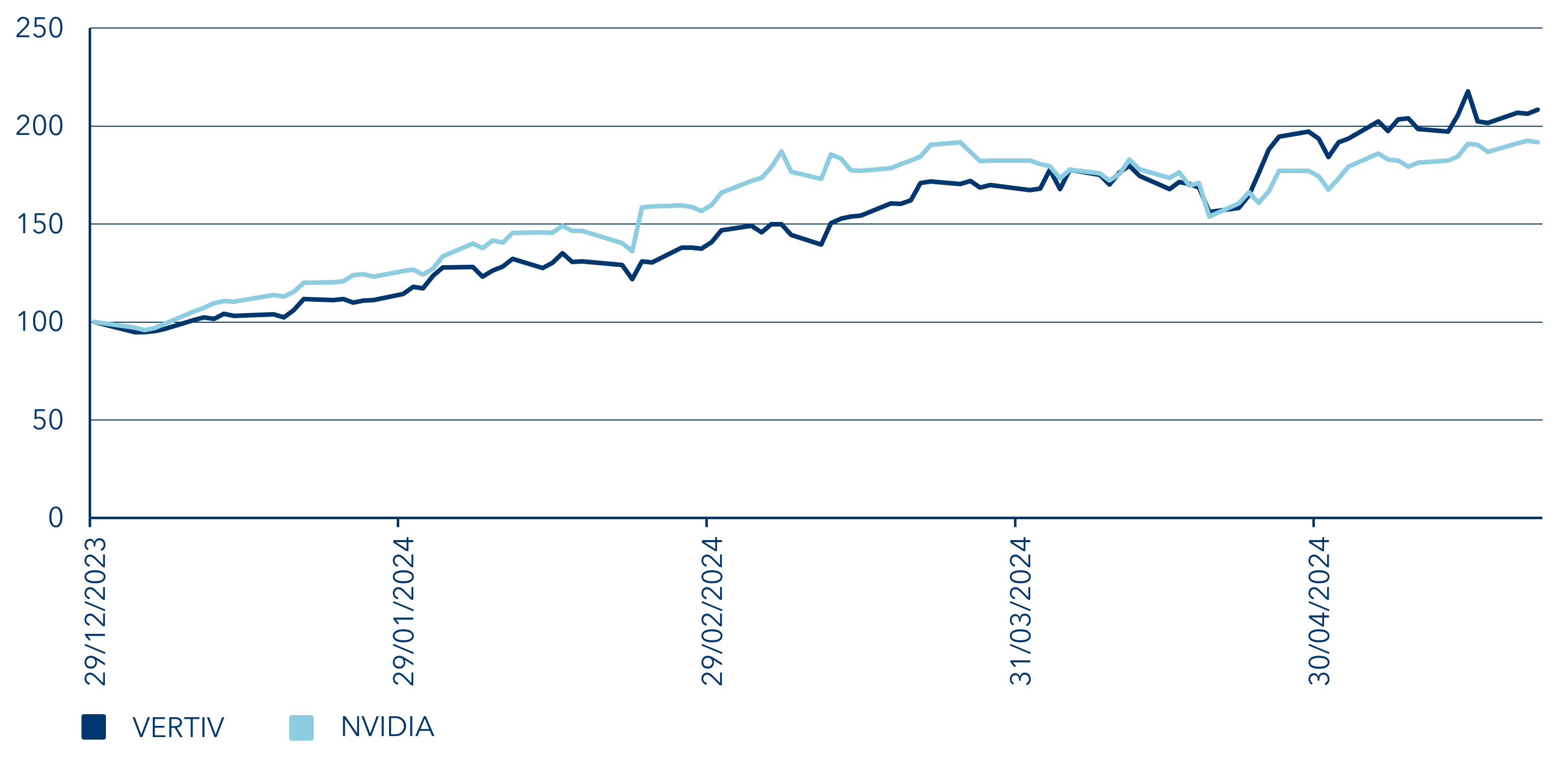

One of the most fascinating aspects of momentum investing is its ability to identify unexpected winners. While many investors focus on obvious trends like chip manufacturers in the field of artificial intelligence, the momentum strategy also recognises less obvious but equally profitable opportunities. For example, infrastructure service providers have benefited from the AI revolution long before this was widely known. Meanwhile, certain names are even outpacing the frontrunner NVIDIA. The graph below shows the indexed price performance of the AI winner Nvidia compared to the infrastructure service provider Vertiv in the U.S.:

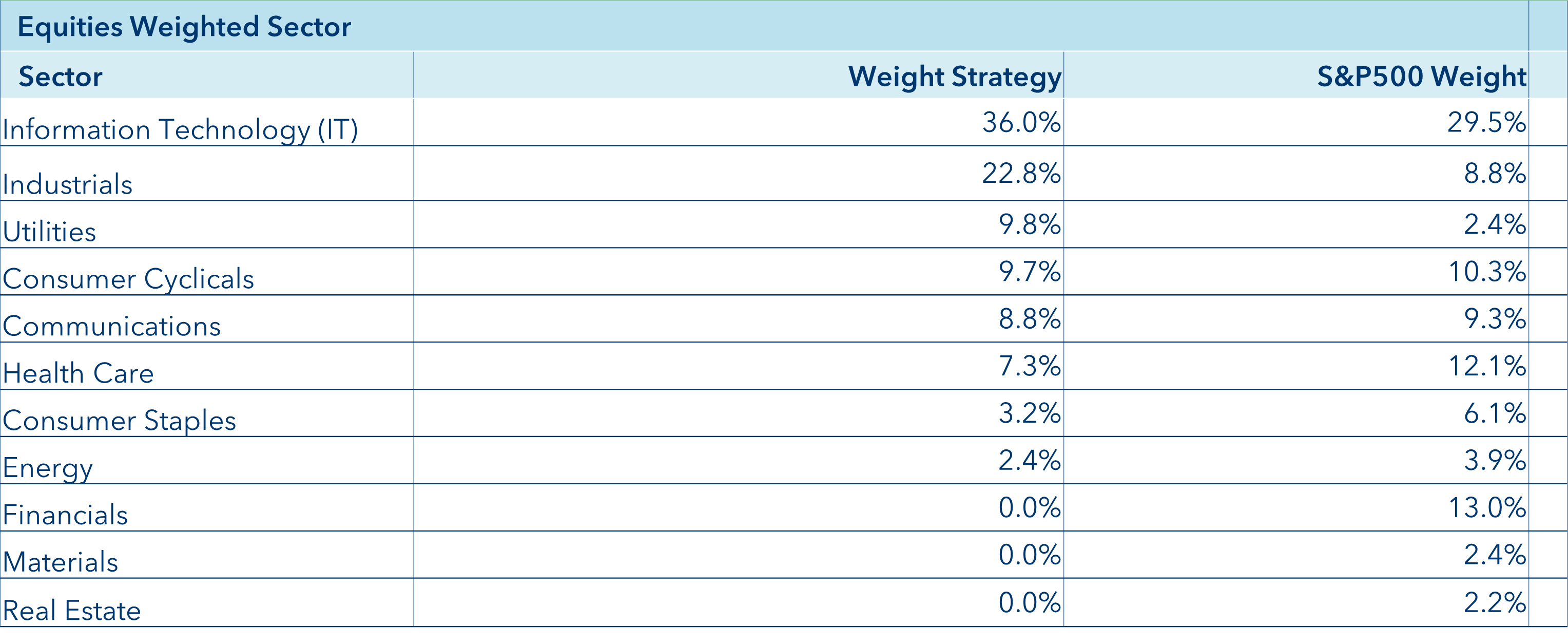

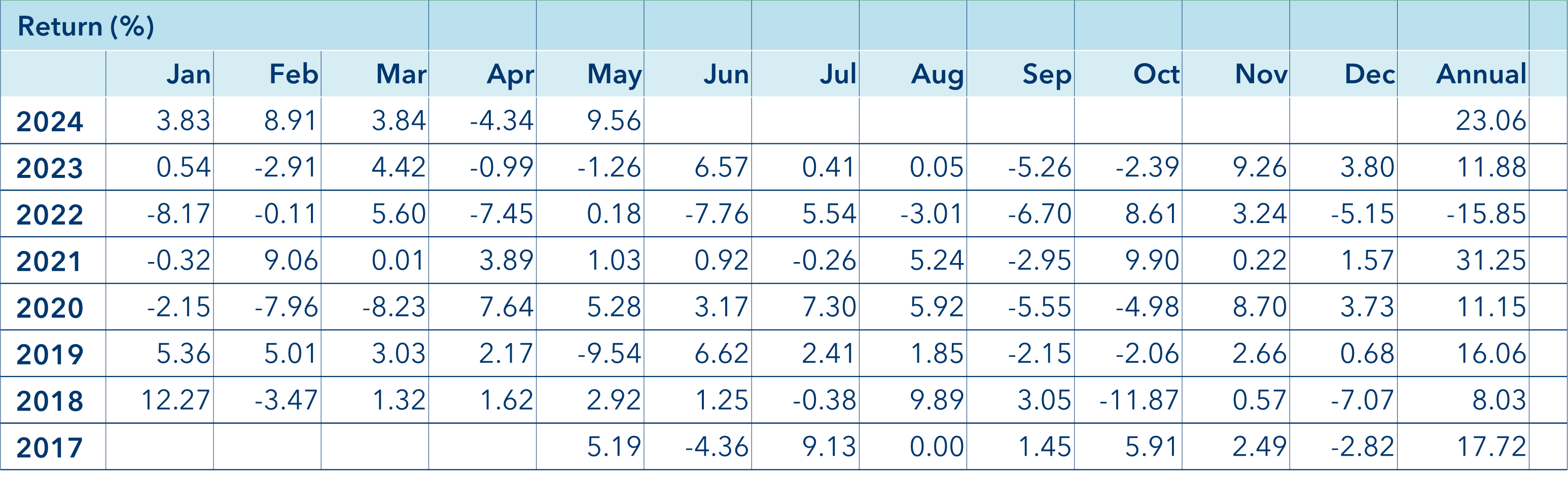

The momentum factor recently identified potential in industrial stocks. Titles that contribute to the energy transition and benefit from the ongoing AI boom are significantly overweighted. In the current year 2024, this strategy has resulted in a gain of over 23% (compared to the overall market at +11.85%). The sector overview shows the strong preferences:

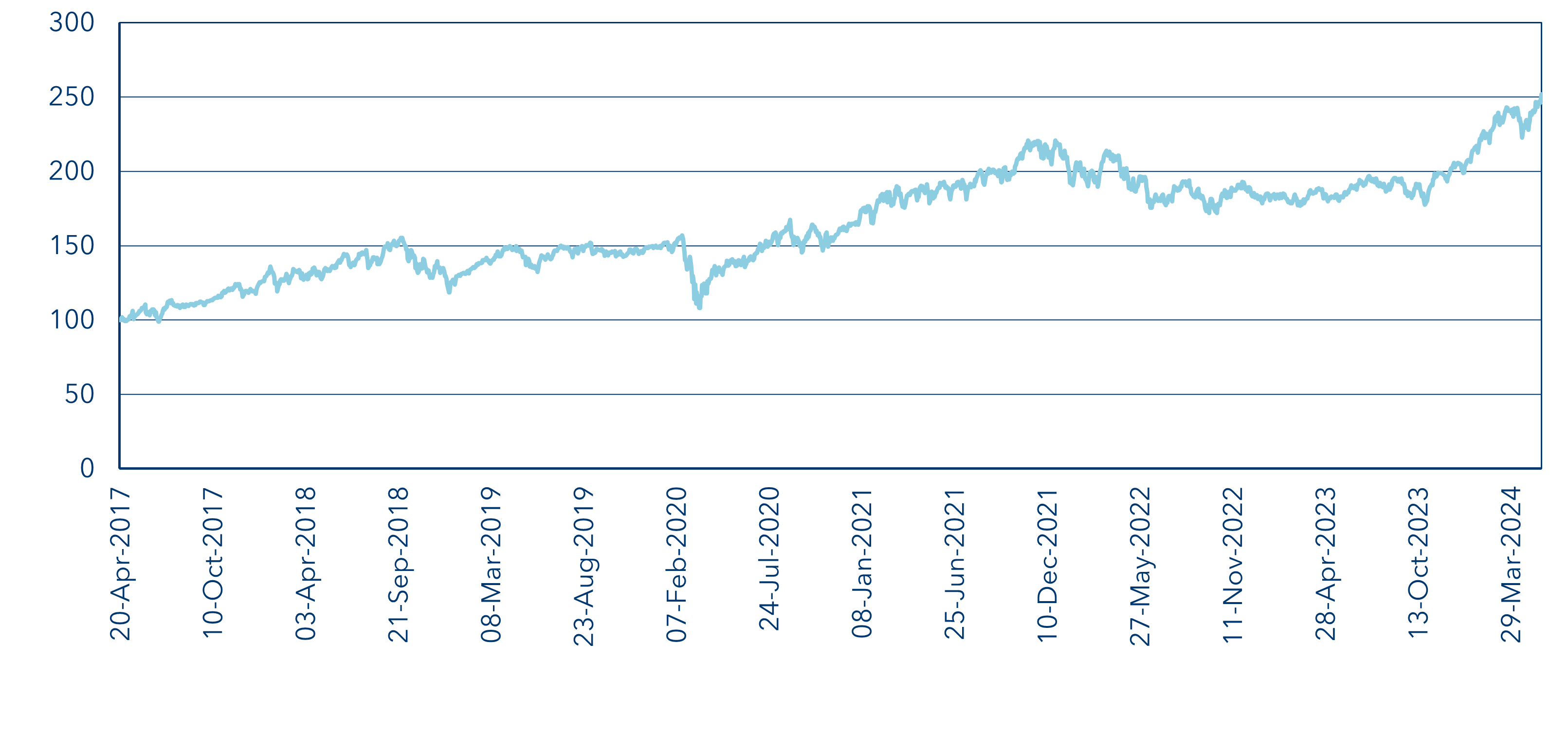

Historic Performance since Launch of the strategy (2017 -2024)

In summary, incorporating momentum investing within a portfolio can systematically increase both diversification and returns without relying on subjective analyses.

About IFS Independent Financial Services Ltd.

IFS Independent Financial Services Ltd. (IFS Ltd.) is an independent Swiss asset manager specialising in the management of private and institutional clients and has been successfully operating in the market for over 20 years. In doing so, IFS Ltd. relies on the expertise of VP Fund Solutions (Liechtenstein) Ltd. in various asset classes for the successful implementation of sensible investment strategies.