Macroeconomic root cause analysis

The positive reaction was a direct consequence of the never-ending negative headlines, combined with Musk's active support for the US president's course. From another perspective, the tech mogul's actions could also be interpreted as a distancing, as the protectionist tones coming from the White House are likely to do more harm than good not only for him, but also for large sections of the business elite.

Even more surprising than Musk's gradual retreat was his critical stance on the president's tariff policy unveiled last Wednesday. Last Saturday, he argued for deeper economic integration between the US and Europe and even called for the abolition of all tariffs. This high-profile contradiction is now echoed by a growing number of big names on Wall Street. Although heavyweights such as Stephen A. Schwarzman (CEO of the Blackstone Group), Timothy Mellon (heir to the founding family of Mellon National Bank) and Kenneth C. Griffin (CEO of Citadel LLC) actively supported Donald Trump's campaign, the announcement of additional tariffs in the Rose Garden of the White House last Wednesday and the proclamation of a "day of liberation" have triggered a growing backlash.

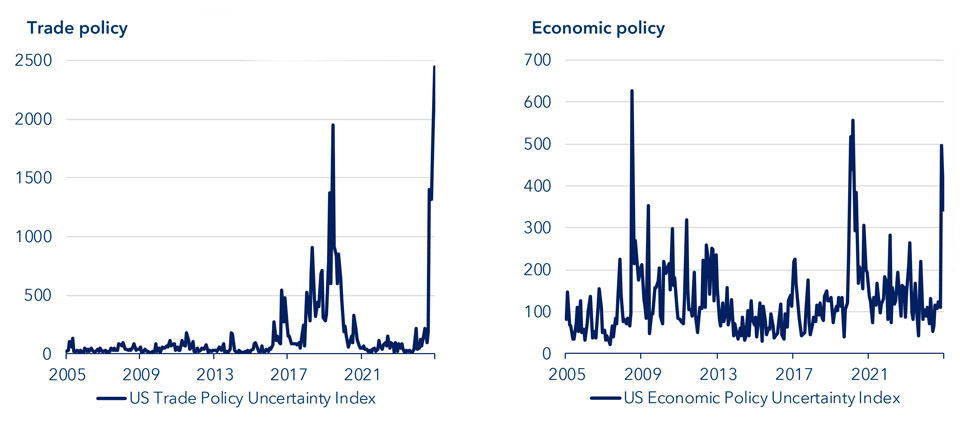

The US administration plans to impose tariffs averaging 25% on its trading partners. Although the US has used tariffs as an economic and political tool in the past, this move represents nothing less than the fastest increase in trade barriers in history. The reaction on the stock markets was not long in coming, leading to a global fall in the major benchmark indices, particularly in the US.

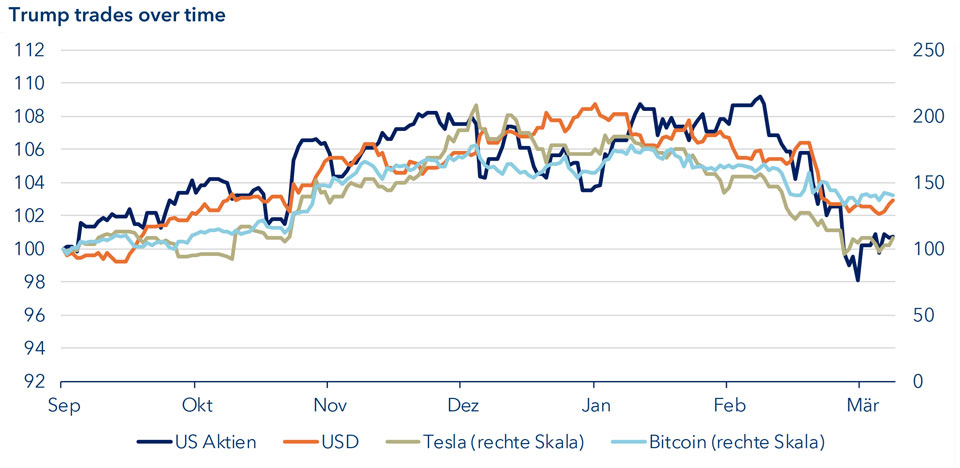

Donald Trump seems all the more determined to push through his policy agenda this term. While his first term was characterised by a provocative approach and a confrontational style to generate pressure, he now intends to completely reverse previous trade policies. Join us as we explore the reasons behind the current economic policy developments and venture a look at possible scenarios in Europe.

Trump 1.0

It should be noted that Donald Trump has positioned himself fundamentally in terms of organisation, goals and methods. For example, the deregulation of many industries - particularly the financial and energy sectors - has been one of the key policies. In addition, the new tax reform in 2017, which reduced corporate taxes from 35% to 21%, led to a sharp increase in corporate profits.

In the following years of his first term, US stock indices also reached record highs. The catalysts for this stock market boom were the recovery of the markets after the COVID-19 pandemic and an expansionary monetary policy. It was these policies that won him the support of Wall Street. Although the trade war with China and Mexico (including tariffs on washing machines, solar panels, aluminium and steel) took place during Trump's first term, the measures announced were not implemented after several rounds of negotiations.

Trump 2.0

While the impact of Trump's measures has been a bull market for equity markets, the impact on bond and interest rate markets is likely to be much greater in the second term of the Trump administration.

This is mainly due to Trump's policy of tax cuts (for households and companies) and spending programmes. This is likely to lead to a rise in long-term interest rates, higher inflation expectations and a steeper USD yield curve. In particular, the low interest rates on US government bonds will be needed for financing. But that is unlikely to be enough. The CBO is already forecasting that the US national debt will rise to 172% of GDP by 2054 if the announced spending increases are implemented. In particular, this will contribute to a widening of the current account deficit. This deficit is a red flag for the Trump administration, which is determined to fight the existing trade imbalance by all means.

While the impression under Trump 1.0 was that the announced tariffs were primarily intended as a political tool to gain negotiating leverage, build economic pressure and extract political concessions, there are now reasons that go beyond the previous threats and their consequences. In particular, the tariffs announced on Liberation Day are designed to relocate supply chains (target: China), reduce the trade deficit and boost domestic production (targets: China, EU, Japan), and generate revenue to finance the national budget (target: intrinsic).

The impact on Europe

Action generates reaction. As far as Europe is concerned, the mainly trade-related measures should help Europeans to focus more on themselvesThe best example of this is the spending programme, which is still under discussion. According to the European Commission's plans, EUR 650 billion is to be made available for armaments and defence build-up as part of "Re-arm Europe". In addition, individual EU states will have access to joint loans totalling EUR 150 billion. Germany, Europe's largest economy, is also in the process of implementing a new debt programme as part of the formation of a possible coalition government. This would make EUR 500 billion available for infrastructure projects over the next 10 years, on top of the regular budget. It remains to be seen how the EU will react to the announced US tariffs in the coming days.

European equities in focus. European equities have performed relatively well compared to their US counterparts since the beginning of the year, but have also been caught up in the downward spiral in recent days. According to Morgan Stanley, European companies generate 26% of their revenue in the US, as measured by the MSCI Europe. However, this includes some product groups with a current share of 6.5%, which are exempt from the announced tariffs for the time being, such as pharmaceuticals. In addition to the spending programmes announced by European countries, which should benefit domestic production in particular, the relatively cheap valuation of European equities is also an advantage. Trump's actions are creating a lasting rift in the transatlantic alliance, which European leaders increasingly see as a historic opportunity for greater unity in Europe. If important reforms to reduce bureaucracy (especially in Germany) can be initiated and important issues such as digitalisation, economic integration and green transformation can be advanced, Europe can ultimately benefit from Trump's policies.