Dividends in times of economic quarantine

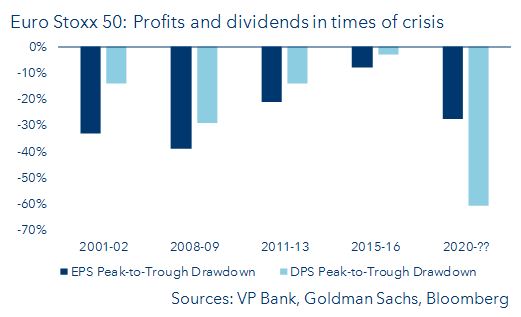

Dividends are far more than just profit distribution. Their development also has a strong signalling effect for investors. Stable dividends over a long period point to sustainable and sound management of companies. Management knows that, and they are careful to adjust dividends too quickly. In times of crisis, dividends are therefore much more stable than profits. Analysts at the US investment bank Goldman Sachs have found that in recent economic crises, neither in Europe nor in the US has the dividend cut ever been greater than the drop in expected earnings (see graph). The current fiscal year could therefore be an exception. This may be due not to the companies themselves, but to government regulations.

Whoever pays orders

In Europe, in particular, governments have combined their support with interest-free emergency loans with the demand not to distribute profits to shareholders. In England, the central bank goes so far as to prohibit cash bonuses for the management at banks. The German government demanded that no listed company should pay dividends by the end of October. The banking sector as a whole has no choice because of the huge liquidity support and must also help governments to ensure liquidity for many small and medium-sized enterprises. In Germany, not all companies follow suit, as many of them continue to earn solid returns.

Dividends as an internal source of financing

Many companies will in any case reconsider the generous distribution policy of recent years. This is partly due to the decline in the company's profit. We expect that the annual profit of US companies included in the S&P500 index will fall by about a third this year. We therefore expect a much greater decline than the consensus of bottom up analysts currently is predicting at -8.5%.

However, because of the economic impasse, the liquidity needs of companies are also increasing. Yet, new debt has become more expensive because financing costs have risen as a result of the crisis, and they jeopardize credit rating. In recent years, rising debt and shareholder friendly policies have led to a broad deterioration in balance sheet quality and thus in credit ratings. Many companies now run the risk of being downgraded to the high-yield segment. Many investors, especially institutional investors, are not allowed by their statutes to buy these low-quality securities. That is why the cost of borrowing for lower rated companies is higher. Companies with weak balance sheets will therefore reduce or cancel distributions to their shareholders in order to reduce the external financing needs. In addition to suspending share buybacks, this also affects dividends.

For more information please contact your client advisor.