Infrastructure boom in Vietnam thanks to "China + 1"

Impacts of the "China + 1" policy on Vietnam

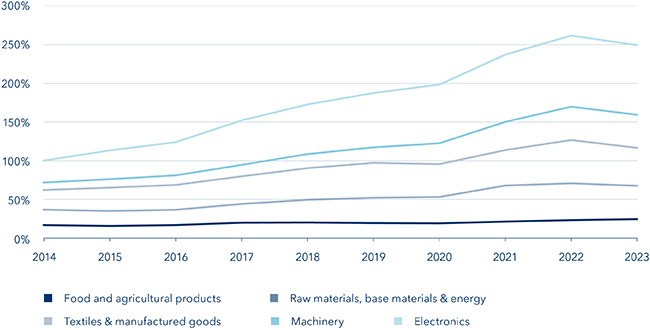

During Asia’s industrialization and modernization process, manufacturing locations shifted as well. What started in Japan around 1870 moved to South Korea in 1960 and three decades later to China and now to countries like Vietnam, India and Indonesia. The reason behind the manufacturing relocation is that production in one country became too expensive while, at the same time, infrastructure, regulation and education caught up in other places, leading to a shift in relative competitiveness. While many countries profit from this shift, Vietnam clearly stands out. Partially because the country offers an attractive combination of the above-mentioned production factors, but also thanks to the country’s geographical proximity and cultural similarity to China. Hence, Vietnam has remained the main beneficiary for production relocation over the past years and will likely keep that position over the next decade. In 2023, on a per capita basis, Vietnam attracted 9.5x more foreign direct investments than India and exported almost 4x more goods than Indonesia. While Thailand, a country well known for exporting machinery and car parts to the European and Asian automotive industry, grew its manufacturing base by 14% over the past ten years, Vietnam expanded its manufacturing capacity by 116%, more than 8x that of Thailand. The supply chain disruptions during the Covid pandemic, as well as geopolitical tensions between China and the West, further accelerated this shift, leading to the famous term "China + 1". Said term describes how many Western companies approach Asia strategically: producing in China for the local Chinese market and producing outside of China for the rest of the world. By capturing a sizeable portion of the production that moved out of China, Vietnam also turned into an export champion. On average, every person exports 88% of their own GDP, placing the country in the top 10 nations globally. This structural change opens an array of investment opportunities.

Exports of goods by year in % of total 2014

Infrastructure need

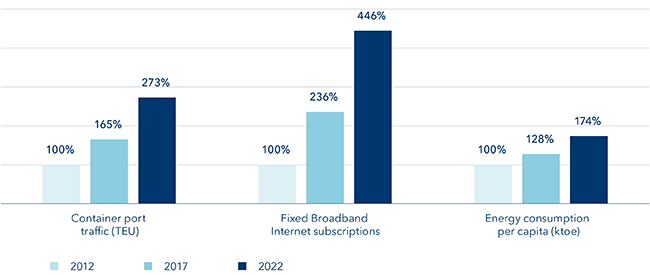

Growing the manufacturing sector by 116% over the past 10 years and increasing exports by 135% over the same period also necessitated massive investments in infrastructure. The country built numerous shipping ports and airports, constructed ring roads around its two major cities, Ho Chi Minh and Hanoi, and connected the North and the South by a highway and an extensive road and railway network. Vietnam also needs to keep up with its surging power demand, which grows at about 9% annually. Despite being a production hub and battling much warmer average temperatures than Switzerland, the average Vietnamese still uses only 50% of the electricity the average Swiss uses. Accordingly, the need and opportunities for future infrastructure investments remain abundant.

Infrastructure developments in Vietnam from 2012 -2022

Investment opportunities

While some demand is covered by Western companies expanding into Vietnam (a recent example is NVIDIA’s decision to build a R&D center focusing on artificial intelligence), the majority of the demand is met by local companies. And while most investors have exposure to the large Western companies, only a few have exposure to Vietnam directly. One reason is that knowledge of the market is often limited and direct access difficult. Accordingly, for most investors, the go-to solution is a diversified fund with a management team that knows the market inside out and can access it directly. With a forward P/E ratio of about 10.5x (the long-term average is about 12x) the index (VNINDEX) is trading at attractive levels. The combination of long-term growth, structural changes and accelerated public spending in the second half of 2024 makes Vietnamese stocks a market to watch closely in 2025 and beyond.