VP Fund Solutions announces awards at the Finanzen Verlag Fund Award, the Mountain View Fund Award and the Lipper Fund Awards

The "Value-Holdings Deutschland" fund, for which VP Fund Solutions (Liechtenstein) AG acts as management company, was awarded the Fund Award 2024 by the German Finanzen Verlag. In the evaluation of the Euro Fund Statistics, the fund achieved 1st place in the category "AF Deutschland/Nebenwerte" over the 3-year evaluation period.

The 'Value-Holdings Deutschland' fund, for which Value-Holdings Capital Partners AG in Augsburg acts as investment advisor, was launched in 2002 and has now been on the market for 24 years. The fund invests in listed companies in Germany.

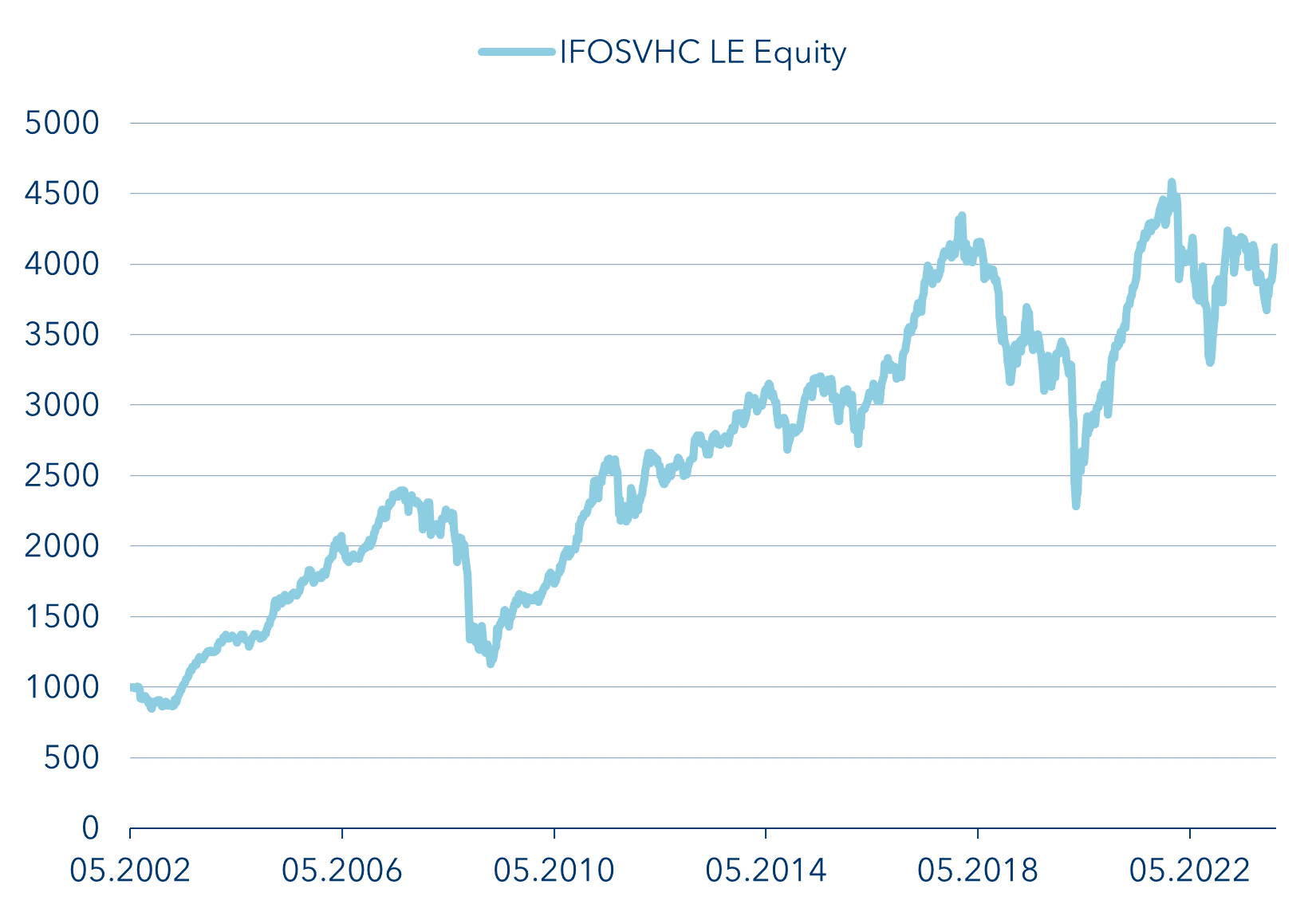

Price performance in EUR

The performance of the fund as of 28 March 2024 shows an exceptional increase of 369 per cent (7.3 per cent annualised) since its launch in 2002.

Another fund managed by VP Fund Solutions was honoured with the Mountain View Fund Award 2024. The "Solitaire Global Bond Fund USD" emerged as the winner in the Mountain View Fund Awards category "Bond Funds Global". The fund stood out in its peer group with an excellent risk/return ratio. The objective of the fund is to generate income and capital gains through interest income. The fund invests in bonds worldwide without geographical or sector restrictions.

As part of the Mountain View Fund Awards 2024, 80,000 investment funds and ETFs from various asset classes with a total volume of more than EUR 8,000 billion were analysed and evaluated in terms of their risk/return ratio over a five-year period. The best and most successful funds of the year are selected from all major global investment strategies and themes.

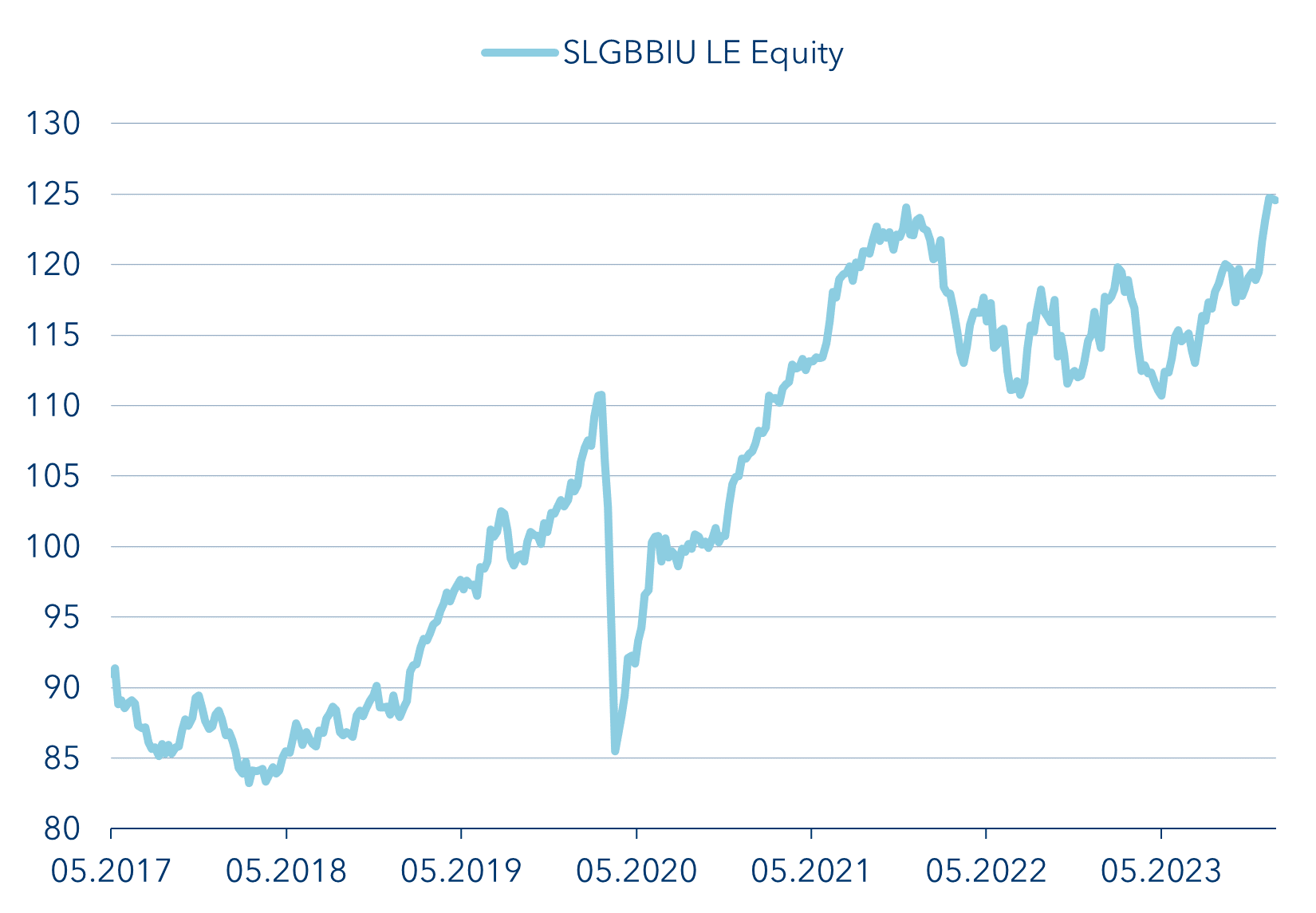

Price performance in USD

As of 28 March 2024, the fund's performance has increased by 71.04 per cent (annualised: 5.36 per cent) since its launch in 2014.

In the spring of 2024, two additional funds on the VP Fund Solutions platform received the Germany 2024 Lipper Fund Award in the "Absolute Return EUR High" category. The Lipper Fund Awards recognise funds and fund management companies for their consistently strong risk-adjusted performance.

Wolfdieter Schnee, Head Fund Client & Investment Services at VP Fund Solutions: "These funds are particularly proven products on our platform and have an extremely remarkable track record. We are delighted with the consistent performance and the long-standing, successful collaboration with Value-Holdings Capital Partners AG from Augsburg and Aquila Asset Management AG from Baar. This success confirms that asset managers can use the expertise of VP Fund Solutions to focus on their core competence - generating investment returns for their investors - by taking over all administrative activities and using the flexible infrastructure of VP Fund Solutions."

We are delighted with the consistent performance and the long-standing, successful collaboration with our partners.

Wolfdieter Schnee Head of Fund Client & Investment Services VP Fund Solutions