Prepare for a second wave

The discrepancy could not be greater. While the extent of the corona measures is becoming increasingly apparent in the economic data, the financial markets have already made up a large part of the losses. It is now in the nature of things that economic data shows reality with a certain delay and that the financial markets reflect expectations. New economic data and political signals play an important role in forming expectations. In our view, the assumptions, especially in the equity markets, seem to be overly optimistic at present, despite the gradual opening of the economy. In our basic economic scenario, which assumes a delayed recovery in the shape of the letter U this year, there is a threat of even stronger negative effects on the profitability and solvency of companies.

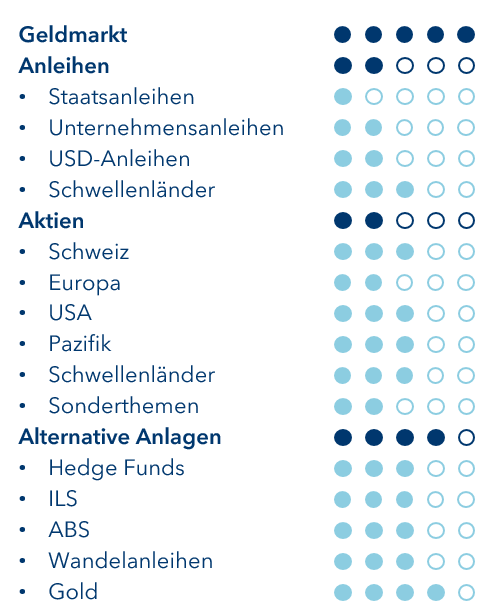

In our view, this is currently not sufficiently reflected in the markets. For this reason, we are cautious with regard to the equity markets in the short term and have decided to reduce our equity exposure. At the same time, diversification remains important. Gold and insurance-linked securities help to make the portfolio more robust. Also, convertible bonds are interesting for us because of their hybrid character. When prices rise, they take on the character of equities; when prices fall, they become more defensive and behave more like bonds.